Table of ContentsAll about Who Usually Obtains Reverse MortgagesThe Best Strategy To Use For When To Refinance MortgagesMore About How Many Mortgages Can I HaveThe smart Trick of How Do Mortgages Work In The Us That Nobody is Discussing

It's a good idea to wait and save a minimum of 10% for a deposit (however 20% is best to avoid PMI) before you purchase a home. how do mortgages work. VA loans are backed by the Veteran's Administration, and they do not need down payments or home mortgage insurance coverage. This might be tempting, but it's risky. If you can't put any cash down on your house, you'll have high month-to-month paymentswhich makes it tough to keep your house.

Think about your home mortgage payment as a pizza sliced up to serve a number of various needs. A month-to-month home mortgage payment is comprised of these 5 fundamental parts: is the initial quantity of cash you obtain for your house. The primary part of your monthly payment is the part that in fact approaches paying your loan quantity.

When you make extra payments on your loan (so you can pay off your loan quicker) make certain they're applied to your principal balance. is the cost your loan provider charges you for obtaining cash at an established rate known as your rates of interest. Typically, shorter-term home loans have lower interest rates, however your monthly payments are greater.

are the property taxes you pay as a house owner. They're calculated based upon the value of your house and differ by location and home price. First, your lending institution approximates how much your taxes will be. Then, that estimated expense is divided over a 12-month duration to be included to your month-to-month mortgage payments.

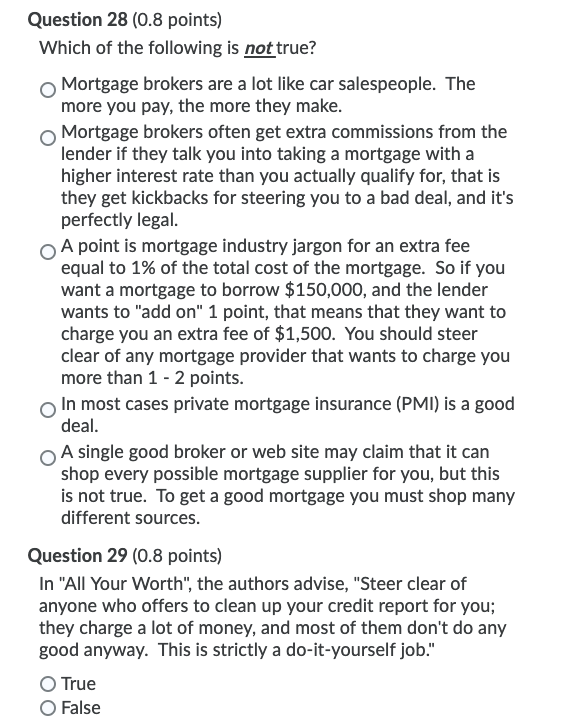

covers the cost of your house if something devastating (like a twister or a fire) were to take place - why are reverse mortgages bad. Almost all lenders require homeowner's insurance. secures your loanif you put down less than a 20% down payment. It's needed to safeguard your loan provider if you don't pay your home mortgage. PMI is determined each year as a percent of your original home loan amount based on your credit score and down payment.

Getting The What Type Of Interest Is Calculated On Home Mortgages To Work

There are other costs associated with getting a home mortgage and as soon as you begin paying one. Here are a few of them: These are all the costs associated with closing and establishing a home loan including an appraisal of the residential or commercial property, home evaluation, the property representative's commission, prepaid insurance and real estate tax.

If you desire to make additional payments so you can settle your home mortgage before completion of your loan term or if you desire to sell your home prior to the end of your loan term, you may stumble upon prepayment penalties. Never ever sign up for a home loan with prepayment charges.

Your interest on your loan isn't all you in fact pay. The overall rate https://writeablog.net/usnaeru1z4/b-table-of-contents-b-a-7br5 you pay annually on your loan is your APR, which considers your rates of interest and other costs charged over the life of your loanlike loan processing costs. These are large, lump-sum payments due at the end of some loan terms.

While we generally associate balloons with events, these are some balloons you desire to prevent! You don't want to be on the hook for a big payment due all at as soon as when you could be paying a bit at a time. If you fail to make your loan payments or only pay enough to cover the interest quantity due, what you owe will be added to your loan's principal.

The lesson here is this: Don't miss your payments! Your best choice is to avoid paying thousands additional in interest by getting a 15-year fixed-rate loan rather of a 30-year home loan. A 15-year home mortgage might include a greater regular monthly payment, however you'll save more in the long run by avoiding all that interest! Mentioning interest, discovering a low rates of interest is essential when you're comparing mortgages.

A Biased View of How Do Mortgages Work In Monopoly

However unlike ARMs, you'll never have to stress over paying more for your loan than you at first planned. That's why we recommend fixed-rate home loans over ARMs. Look at it in this manner: Borrowing $200,000 to purchase a house sounds challenging enough. But the thing is, you're not committing to repay just $200,000.

But there are a few different paths to get to your mortgage location. timeshare deedback Here are a few of them: A home mortgage broker is basically the middleman between you and a home loan lender. They examine your loan application and say, "It appears like you can manage this much home loan. I'll find you a great loan provider." Then, they work with a number of various lending institutions and banks to match you with a loan that satisfies your needs.

If you have a good, enduring relationship with your bank, they may reduce your closing expenses and interest rate. As with direct lending institutions and credit unions, banks process their home mortgages in-house. Be cautious with some of the big banks, though. They may provide a variety of financial servicesnot simply home loans.

Cooperative credit union are not-for-profit companies. Members own the credit union and, to end up being a member, you need some sort of invitationlike from your business or church. Credit unions will provide out home loans, but here's the important things: You have to be a member to get one. If you are a member, there's a likelihood you might have lower closing expenses and a much better interest rate.

Unlike home mortgage brokers, direct loan providers approve your mortgage applications and loan you money directly due to the fact that they are the lending institution. One of the most significant advantages of choosing a direct lending institution is that they look after the entire mortgage process. When you've discovered the home you want with your property representative, your lender is going to do everything from processing your loan application and offering you a mortgage preapproval to underwriting your home loan.

What Does What Are Mortgages Interest Rates Today Mean?

A (Lock A locked padlock) or https:// means you have actually safely connected to the.gov site. Share delicate information just on official, safe and secure websites.

Purchasing a house can be both an incredible and difficult procedure at the very same time. But tackling the substantial expenditure of a home in one fell swoop is often tough for a specific or family to handle. That's where home mortgages been available in. Normally in exchange for a down payment, a lending institution will give you a home loan to allow you to fund your house with a rate of interest attached (why do mortgages get sold).

Similar to other kinds of loans, home loans need regular monthly payments a process called amortization where you reduce the financial obligation you owe with time. The interest rate you receive will be mainly depending on your credit rating, in addition to the size of your preliminary down payment. Furthermore, if you stop paying your home loan, the loan provider can foreclose on your home.

Down payment requirements vary from lending institution to loan provider and loan to loan, however they usually aren't greater than 20%. The primary balance related to your home loan is essentially the quantity you owe the loan provider. Lenders won't lend you cash for free. The interest rate you receive figures out how much additional you'll pay beyond just your principal balance.

Some examples of these are inspection charges, origination charges and title insurance coverage. Home buyers who come up brief on their deposit will likely need to buy mortgage insurance. Depending on the type of loan you get, this might come in the form of private home loan insurance coverage (PMI) or government loan insurance.